13 Best and Legit Loan Apps in the Philippines 2025

There are many different loan apps in the Philippines. You can find a loan app to fit your specific needs, whether…

There are many different loan apps in the Philippines. You can find a loan app to fit your specific needs, whether you need an online loan, a personal loan, or a business loan for business owners.

In recent years, a handful of fintech companies have made it easy for Filipinos to apply for loans. With these loans having less rigid requirements than banks, it presents a unique opportunity for those who may not qualify for traditional loans or have the luxury of time to wait long for loan approvals.

Related posts:

Best Loan Apps with Lowest Interest Rates

If we only consider the interest rates and set aside other factors like loan amounts, repayment terms, here are the top ten loan apps with low interest rates.

| Loan App | Interest Rate (per month) | Max Loan Amount |

|---|---|---|

| 1. PesoCash | 1.5% | ₱10,000 |

| 2. PesoQ | 1.5% to 1.8% | ₱20,000 |

| 3. Home Credit | 3%, but 32% downpayment | ₱150,000 |

| 4. BillEase | 3.49% | ₱40,000 |

| 5. Maya Credit | 3.99% to 5% | ₱18,000 |

| 6. Atome | 5.5% | ₱50,000 |

| 7. Cashalo | 3.95% to 5.99% | ₱10,000 |

| 8. Tonik | 6% | ₱20,000 |

| 9. GLoan | 1.59% to 6.57% | ₱125,000 |

| 10. JuanHand | 9% | ₱15,000 |

1. Home Credit Philippines

- Best for: Purchase of appliances and gadgets

- App Store Rating: 4.8/5.0 Stars ★★★★★ (18k reviews)

- Play Store Rating: 4.7/5.0 Stars ★★★★★ (444k reviews)

- Loan amount: ₱5,000 to ₱150,000

- Interest rates: 3% per month (+32% downpayment)

- Loan terms: 6 months to 36 months

- Application requirements:

- Filipino citizen, 18-68 years old

- 1 Primary ID

- Must have an reliable source of income from employment, business, pension, and remittances

Home Credit is a leading consumer finance provider in the Philippines. It offers online loans, credit cards, and other financial products to help customers access their needs. Home Credit works with a network of partner stores like Abenson, Beyond the Box, Ace Hardware, etc., so you can apply for a loan (Buy Now, Pay Later) at the store where you’re making your purchase.

Home Credit Philippines is a great option for people looking to loan money when buying products and paying in affordable installments. What’s best is that you can also pay your Home Credit loan via GCash, online banking, or payment partners.

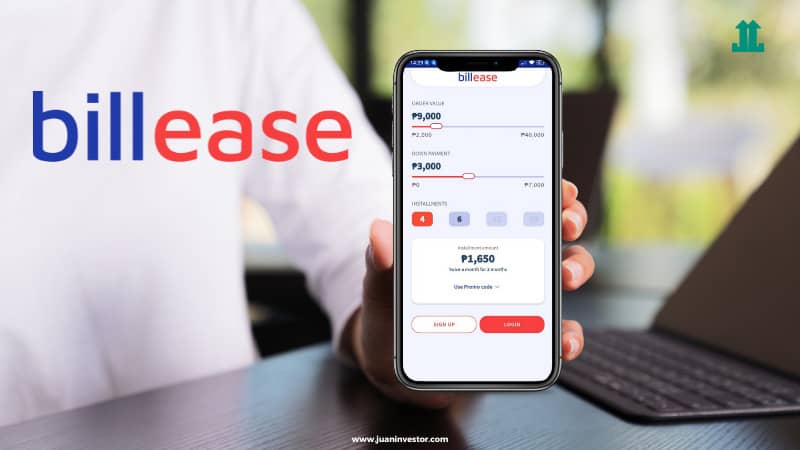

2. BillEase

- Best for: Immediate cash to pay utility bills, appliances or gadgets

- App Store Rating: 4.5/5.0 Stars ★★★★★ (7.4k reviews)

- Play Store Rating: 4.7/5.0 Stars ★★★★★ (130k reviews)

- Loan amount: ₱2,000 to ₱40,000

- Interest rates: 3.49% per month

- Loan terms: 2 months to 24 months

- Application requirements:

- 1 Primary ID

- Proof of income

- Proof of billing

BillEase is the Philippines’ first installment loan app that allows people to pay for their online and offline purchases in monthly installments with 0% interest. That means there are no late payment fees, service charges, or hidden costs.

You can pay for your online or offline purchases monthly with 0% interest. It also has an AutoPay feature to avoid late payments and a budgeting and spending tracking feature to help you manage your finances. If you are looking for a loan app with the lowest interest rate and flexible repayment options, BillEase is the best loan app for you.

3. Cashalo

- Best for: Online shopping or immediate cash for utility bills

- App Store Rating: 4.2/5.0 Stars ★★★★★ (7.5k reviews)

- Play Store Rating: 4.1/5.0 Stars ★★★★★ (167k reviews)

- Loan amount: ₱1,000 to ₱10,000

- Interest rates: 3.95% to 5.99% per month

- Loan terms: 2 months to 24 months

- Application requirements:

- 1 Primary ID

- Proof of income

- Proof of billing

- Bank account details

Cashalo is a popular loan choice in the Philippines for many reasons. For one, Cashalo offers a straightforward application process. All you need to do is fill out a short form and submit it online, and you can get approved for a loan in just a few minutes.

Cashalo offers very competitive interest rates, making it an affordable option for many borrowers. In addition, Cashalo offers flexible repayment terms, so you can choose a plan that best suits your needs. Cashalo is a great choice for anyone in the Philippines looking for a quick and easy loan.

Cashalo also offers flexible repayment terms, so you can choose a plan that fits your budget. Cashalo is a trusted and reputable lender, so you can be confident that you’re getting a fair deal.

4. GLoan (GCash Loan)

- Best for: GCash users with high GScore

- App Store Rating: 3.2/5.0 Stars ★★★★★ (63k reviews)

- Play Store Rating: 3.8/5.0 Stars ★★★★★ (1.88M reviews)

- Loan amount: up to ₱125,000

- Interest rates: 0% for 14 days, 1.59% to 6.57% per month

- Loan terms: 14 days to 24 months

- Application requirements:

- Filipino citizen, 21 to 65 years old

- a fully-verified GCash account

- good credit record, no fraudulent transactions

- a good G-SCore

GLoan or GCash Loan is a mobile loan app offered by GCash, a leading e-wallet provider in the Philippines. The loan app provides a quick and easy way to access cash loans for urgent needs or unexpected expenses. You can loan up to Php 125,000 with a low-interest rate of 1.59% to 6.57% per month, making it an affordable option for borrowers.

The repayment terms are also flexible, ranging from 14 days up to 24 months, giving borrowers enough time to pay back the loan without causing financial strain.

Read our detailed post if you want to know how to loan in GCash via GLoan.

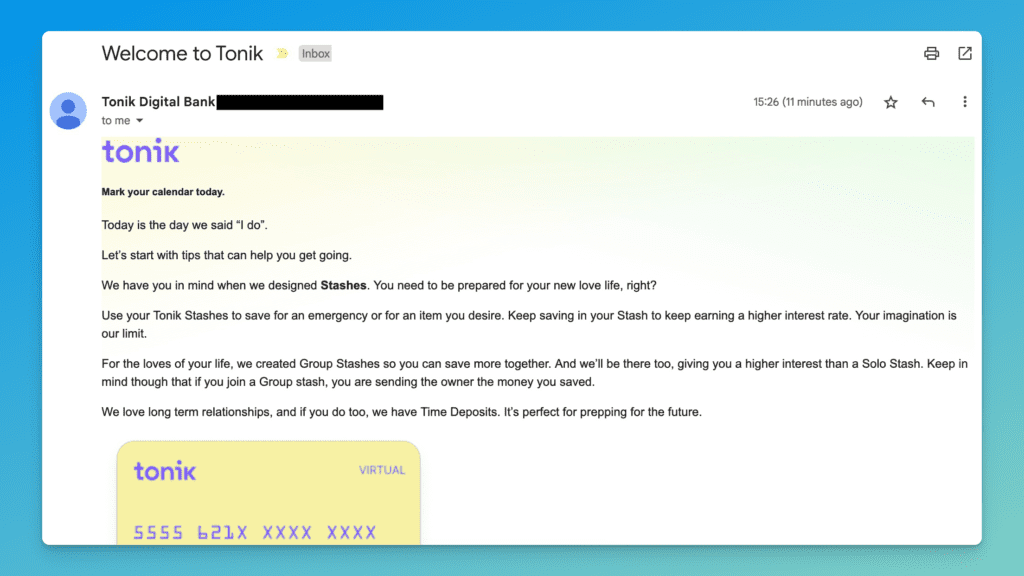

5. Tonik Bank

- Best for: Microloans, appliances or gadgets

- App Store Rating: 4.5/5.0 Stars ★★★★★ (11k reviews)

- Play Store Rating: 4.5/5.0 Stars ★★★★★ (71.6k reviews)

- Credit Builder Loan

- Loan amount: up to ₱20,000

- Interest rates: 4.84% to 4.91% per month

- Loan terms: 6 months to 12 months

- Application requirements:

- Filipino citizen, 23 to 58 years old

- 1 Valid ID

- Tonik Savings account

- Valid Tax Identification Number (TIN)

- Shop Installment Loan

- Loan amount: ₱5,000 to ₱100,000

- Interest rates: 4.5% per month (+10% downpayment)

- Loan terms: 3 months to 12 months

- Application requirements:

- 1 Valid ID

- Tonik Savings account

Tonik is rapidly gaining traction among young Filipino professionals who appreciate the simplicity and transparency it brings to the lending process. As the Philippines’ first digital-only neobank, Tonik offers a refreshing approach to personal finance.

Their website, TonikBank.com, provides a user-friendly interface where you can quickly apply for loans without the usual hassle of traditional banking. What’s particularly appealing is their promise of no hidden fees and competitive interest rates, which resonate well with millennials and young professionals looking to manage their finances smartly and efficiently.

Tonik Bank offers retail financial products including deposits, loans, savings accounts, payments, and cards on a highly secure platform.

According to user testimonials, Tonik makes financial services accessible and straightforward. One user, Mark, a 32-year-old IT professional from Manila, shared:

Applying for a loan with Tonik was a breeze! I was surprised by how fast the approval was, and the terms were very clear—no fine print to worry about. It’s perfect for when you need quick cash for emergencies or to simply manage cash flow better.

~Mark, IT Professional

Financial experts also praise Tonik for its innovative use of technology to secure transactions and protect user data, making it a safe choice for young professionals who value security and privacy. This blend of speed, transparency, and security makes Tonik a standout choice in the crowded field of loan apps in the Philippines.

If you’re new or want to learn more, read our detailed review of Tonik Bank.

6. JuanHand

- App Store Rating: 4.7/5.0 Stars ★★★★★ (21k reviews)

- Play Store Rating: 4.0/5.0 Stars ★★★★☆ (73.5k reviews)

JuanHand is a loan app in the Philippines that offers quick and easy loans to users. JuanHand is different from other loan apps because it offers several unique features that make it an ideal choice for users in the Philippines.

| Aspect | Value |

|---|---|

| Loan Terms | 1 month to 3 months |

| Interest Rates | 9% per month |

| Loan Amount | ₱2,000 to ₱15,000 |

It offers a lower interest rate than other loan apps, making it a more affordable option for users. JuanHand is also a more user-friendly app with an easy-to-use interface that simplifies applying for and managing your loan.

Highlights

- Fast online cash loans: JuanHand provides fast online cash loans to Filipinos in need of quick access to cash

- Easy application: To apply for a loan, simply download the JuanHand app, sign up using your mobile number

- Privacy policy: JuanHand has a privacy policy that outlines how user data is collected, used, and shared

- Legitimacy: JuanHand is a legitimate online lending company that provides financial help to Filipinos

7. PesoQ

- Play Store Rating: 4.4/5.0 Stars ★★★★★ (140k reviews)

PesoQ is a popular loan app in the Philippines that provides an easy-operation, no-collateral online peso lending platform for cash loans and credit. It provides fast and easy loans to Filipinos in need of quick access to cash. With its flexible loans, mobile app, and SEC registration, PesoQ has become a popular choice for many Filipinos.

| Aspect | Value |

|---|---|

| Loan Terms | 3 months to 6 months |

| Interest Rates | 1.5% to 1.8% per month |

| Loan Amount | ₱5,000 to ₱20,000 |

There are many reasons why people choose PesoQ over other lenders, but some of the most common reasons include the following:

- It offers low-interest rates for its loans, making them more affordable for borrowers.

- They offer various loan products, so borrowers can find a loan that meets their needs.

- They have a strong customer service team that is available to help borrowers with any questions or concerns they may have.

Highlights

- Fast and easy approval: PesoQ offers fast and easy loan approval within minutes

- Flexible loans: PesoQ provides various types of legit online loans to meet various needs

- Mobile app: PesoQ operates solely online and receives loan applications through a dedicated mobile application

- SEC-registered: PesoQ is registered with the SEC, making it a legitimate online lending company in the Philippines

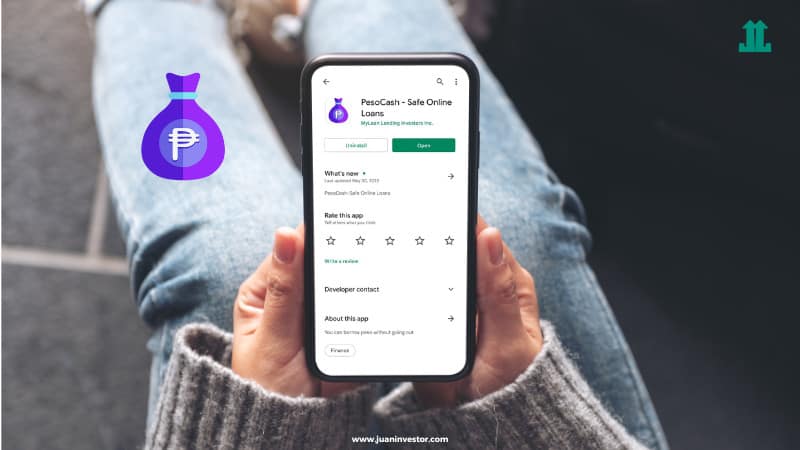

8. PesoCash

- Play Store Rating: 4.4/5.0 Stars ★★★★★ (98.6k reviews)

PesoCash is a popular loan app in the Philippines that provides safe online loans to Filipinos in need of quick access to cash. It allows users to access quick and easy loans in the Philippines. The app offers loans of up to PHP 10,000 with no collateral and no hidden fees. With its SEC registration, privacy policy, and fast approval process, PesoCash has become a popular choice for many Filipinos.

| Aspect | Value |

|---|---|

| Loan Terms | 3 months to 12 months |

| Interest Rates | 1.5% per month |

| Loan Amount | ₱4,000 to ₱10,000 |

Highlights

- Safe online loans: PesoCash provides safe online loans to Filipinos in need of quick access to cash

- SEC-registered: PesoCash is registered with the SEC, making it a legitimate online lending company in the Philippines

- Privacy policy: PesoCash has a privacy policy that outlines how user data is collected, used, and shared

- Fast approval: PesoCash offers fast loan approval within 24 hours

- Convenient access: PesoCash is available on both Android and iOS devices, making it convenient for Filipinos to access the loan app

9. Digido

- App Store Rating: 4.4/5.0 Stars ★★★★★ (9.2k reviews)

- Play Store Rating: 4.2/5.0 Stars ★★★★★ (25.3k reviews)

Digido (formerly Robocash) is a popular loan app in the Philippines that provides fast and reliable online loans to meet various needs

| Aspect | Value |

|---|---|

| Loan Terms | 3 months to 6 months |

| Interest Rates | 3% to 12% per month |

| Loan Amount | ₱1,000 to ₱25,000 |

Digido Finance Corp. is a state-licensed online lending company that started in 2021. With its automated loan lending system and easy approval process, Digido has become a popular loan app in the Philippines for those who need quick access to cash.

Highlights

- Automated loan lending system: Digido provides a fully automated online portal as well as highly innovative, customer-friendly financial solutions

- Short-term loans: Digido offers short-term loans ranging from PHP 1000 to 25000 for up to 30 days

- Easy approval: Digido has a 95% chance of loan approval, making it a game changer in the lending industry

- Mitigation of financial emergency: The primary purpose of cash loans is to mitigate a financial emergency

- No bank account required: Digido guarantees quick loans even without a bank account, making it a popular choice for many Filipinos

10. Maya Credit

- App Store Rating: 4.8/5.0 Stars ★★★★★ (202k reviews)

- Play Store Rating: 4.7/5.0 Stars ★★★★★ (1.2M reviews)

Maya Credit is a feature integrated within the Maya banking app, an all-in-one digital banking platform developed by PayMaya Philippines. Your eligibility for Maya Credit and your credit limit are based on how frequently you use Maya’s services. The more you’ve used Maya’s services prior to applying, the higher your potential credit limit.

| Aspect | Value |

|---|---|

| Loan Terms | 30 days |

| Interest Rates | 3.99% to 5% per month |

| Loan Amount | ₱500 to ₱18,000 |

Maya Credit is a loan feature that gives users a reliable financial safety net in times of need. If you choose Maya Credit as your payment option, the bank reserves the right to automatically deduct your loan outstanding balance from your Maya wallet or any of the accounts linked to it.

Highlights

- Automatic Deductions: The repayment of loans can be automated, with the bank reserving the right to deduct outstanding balances directly from your Maya wallet or linked accounts.

- Integrated with a comprehensive banking app: Maya Credit is part of the all-in-one Maya app, which provides a diverse range of banking and financial services.

- Flexible Repayment: The credit feature offers a variety of repayment options tailored to suit individual financial circumstances.

- Separate from Other Maya Services: Maya Credit operates independently from other Maya app services, such as the ‘Maya Pay in 4’ installment payment option

- Accessibility: As long as their accounts are in good standing, all users of the Maya app have access to Maya Credit.

- Security: Maya Credit ensures that all transactions are secure, maintaining privacy and security of user data.

11. Tala Philippines

- Play Store Rating: 4.7/5.0 Stars ★★★★★ (644k reviews)

Tala Philippines is a popular loan app in the Philippines that provides instant loans through a mobile app. It’s a trusted loan app that provides fast and flexible loans to Filipinos in need of quick access to cash. With its instant loans, fast approval, and low interest rates, Tala has become a popular choice for many Filipinos.

| Aspect | Value |

|---|---|

| Loan Terms | 21 days to 30 days |

| Interest Rates | 14.5% to 15% per month |

| Loan Amount | ₱1,000 to ₱15,000 |

Highlights

- Instant loans: Tala provides instant loans through a mobile app, from loan application to funds release and status tracking

- Fast approval: more than 5 million downloads in the Philippines

- Flexible loans: Tala takes pride in providing fast, flexible, and secure loans in the Philippines

- Low-interest rate: Tala offers online personal loans up to PHP 15,000 with low interest and easy payment options

- Registered and legitimate: legitimate online lender that’s registered with the SEC as Tala Financing Philippines Inc

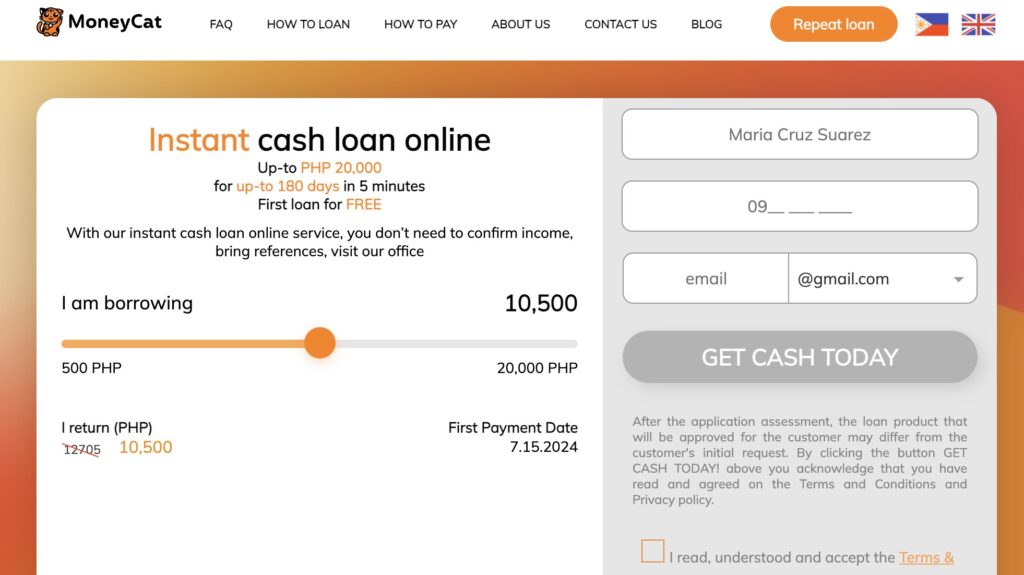

12. MoneyCat

- Play Store Rating: 4.6/5.0 Stars ★★★★★ (162k reviews)

If you’re on the hunt for a reliable loan app, MoneyCat might just be the purr-fect solution (pun intended). Let’s dive into what makes MoneyCat a solid choice for employed Filipino millennials and young professionals who need a bit of financial help without the fear of getting scammed.

| Aspect | Value |

|---|---|

| Loan Terms | 3 months to 6 months |

| Interest Rates | 11.9% per month |

| Loan Amount | ₱500 to ₱20,000 |

Highlights

- Fast and easy application process

- Flexible loan amounts

- Quick approval and disbursements

- User-Friendly Interface: The app is designed to be easy to navigate, even if you’re not tech-savvy.

- No Hidden Fees: MoneyCat is transparent about its fees. What you see is what you get, so you don’t have to worry about unexpected charges popping up later.

- Flexible Repayment Terms: They offer a range of repayment terms, so you can choose the one that best fits your financial situation. Whether you need a few weeks or a few months, you have options.

13. Atome

- App Store Rating: 4.8/5.0 Stars ★★★★★ (53k reviews)

- Play Store Rating: 4.8/5.0 Stars ★★★★★ (80.9k reviews)

Atome shines with its zero-interest installment plans, easy application process, and extensive network of partner merchants. It’s a powerful tool for anyone looking to manage their finances more flexibly and responsibly. Just remember to keep track of your payments to avoid any late fees.

| Aspect | Value |

|---|---|

| Loan Terms | up to 12 months |

| Interest Rates | 5.5% per month |

| Loan Amount | up to ₱50,000 |

Highlights

- Buy Now, Pay Later: perfect if you need to make a purchase but are short on cash. This allows you to buy what you need and spread out the payments over time.

- No interest installments: You can split your purchases into manageable payments without worrying about accumulating interest.

- Wide network of partner merchants: from fashion and electronics to travel and lifestyle, this means you can use the app to shop at your favorite stores and enjoy the convenience of flexible payment options.

- Easy application process: The app is user-friendly, and the interface is intuitive, making the whole process smooth and hassle-free.

- Wide acceptance: Atome is versatile and convenient for various types of purchases.

How to Look for the Best Loan App

Finding the right loan app can feel like looking for a fish in the ocean, especially with so many options out there. But don’t worry, I’ve got your back! Here’s a friendly guide on what to look for in a loan app to ensure you’re making a smart and safe choice.

a. Security and Legitimacy

Regulatory Compliance

First things first, make sure the loan app is legit. Check if it’s registered with the Securities and Exchange Commission (SEC) in the Philippines. This is your first line of defense against scams. An SEC registration means the app is playing by the rules and has passed some basic checks.

User Reviews and Ratings

Next, do a bit of detective work. Look at user reviews and ratings on the App Store or Google Play. Real users will spill the tea on their experiences, both good and bad. If an app has lots of negative reviews or super low ratings, it’s a red flag. Go for apps that have positive feedback and high ratings.

b. Interest Rates and Fees

Compare Interest Rates

Interest rates can vary widely between loan apps. Some might offer low rates that seem too good to be true, while others might charge an arm and a leg. Compare the rates of different apps and see which one offers the best deal for your needs. Remember, a lower interest rate means you’ll pay less in the long run.

Hidden Fees to Watch Out For

Watch out for sneaky hidden fees. Some apps might have additional charges like processing fees, late payment fees, or even early repayment fees. Make sure you read the fine print so you’re not caught off guard later. Transparency is key, so choose an app that lays out all its fees upfront.

c. Loan Approval Process

Required Documents

The loan approval process can vary from app to app. Some might ask for a ton of documents, while others might just need a few basics. Generally, you’ll need a valid ID, proof of income, and possibly some references. Choose an app that has a straightforward and hassle-free process.

Approval Timeframe

Nobody likes waiting forever for anything, especially money. Check how long it takes for the app to approve your loan. Some apps pride themselves on quick approvals, sometimes within minutes. Others might take a few days. If you need cash fast, go for an app with a speedy approval process.

d. Repayment Terms

Flexibility in Repayment

Look at the repayment terms the app offers. Some apps might require you to repay the loan in a few weeks, while others offer longer terms. Choose an app that gives you enough time to repay without causing too much strain on your budget. Flexibility is a big plus!

Penalties for Late Payments

Life happens, and sometimes you might miss a payment. Check what penalties the app imposes for late payments. Some might charge hefty late fees, while others might be more lenient. Knowing this ahead of time can save you from unexpected surprises.

e. Customer Support

Availability and Channels

Good customer support is crucial, especially if you run into issues. Check if the app offers multiple channels for support like chat, email, or phone. Also, see if they’re available during hours that are convenient for you. The last thing you want is to be stuck without help when you need it.

User Experience

Finally, consider the overall user experience. Is the app easy to navigate? Is the interface friendly and intuitive? A good loan app should be user-friendly and make the entire process as painless as possible. If an app is clunky or confusing, it’s probably not worth your time.

How to Avoid Loan App Scams

The world of loan apps can be a bit daunting, especially with all the horror stories about scams. But don’t worry, I’ve got some tips to help you stay safe and make sure you’re dealing with the real deal.

Red Flags to Watch Out For

1. Unclear Terms and Conditions

One of the biggest warning signs of a scammy loan app is unclear or vague terms and conditions. Legitimate loan apps will be upfront about their fees, interest rates, and repayment terms. If an app makes it hard to find this information or uses a lot of confusing jargon, it’s a big red flag. Always read the fine print and make sure you understand what you’re signing up for.

2. No Physical Address or Contact Information

A trustworthy loan app will have a physical address and multiple ways to contact them, like a phone number, email, or live chat. If an app doesn’t provide any contact information or only has a generic email address, it’s best to steer clear. You want to be able to reach out to someone if you have questions or issues.

3. Pressure Tactics

Be wary of loan apps that pressure you to make quick decisions. Scammers often create a sense of urgency to make you act without thinking. Legitimate loan providers will give you time to review the terms and make an informed decision. If you feel rushed or pressured, it’s a sign that something isn’t right.

Verify Loan Apps

1. Check for SEC Registration

In the Philippines, legitimate loan apps are registered with the Securities and Exchange Commission (SEC). Before you download and use a loan app, check if it’s listed on the SEC website. This registration means the app has passed certain checks and is authorized to operate. It’s a simple step that can save you a lot of trouble.

2. Read User Reviews

User reviews can be incredibly helpful in spotting scams. Check Reddit, App Store, or Google Play for reviews from other users. Look for patterns in the reviews – if multiple people mention hidden fees or poor customer service, it’s a red flag. On the flip side, positive reviews can give you confidence that the app is trustworthy.

3. Look for Red Flags in Reviews

While reading reviews, pay attention to any mentions of unexpected charges, difficulty in contacting customer support, or issues with repayment. These can be indicators of a scam. Legitimate loan apps will have mostly positive reviews and transparent feedback from users.

Trust Your Gut

1. If It Sounds Too Good to Be True, It Probably Is

We’ve all heard this cliché, but it’s true. If a loan app promises unbelievably low interest rates, no fees, or instant approval without any checks, it’s probably too good to be true. Scammers use these tactics to lure in unsuspecting victims. Trust your instincts and do your research.

2. Ask for Recommendations

Sometimes the best way to find a trustworthy loan app is through word of mouth. Ask friends, family, or colleagues if they’ve used any loan apps and what their experiences were like. Personal recommendations can be more reliable than online reviews.

What is a Loan App?

A loan app is a mobile application that allows users to apply for loans and track their loan repayments. Loan apps typically offer up to PHP 50,000 with flexible repayment terms.

How do Loan Apps work?

Loan apps typically use a lending algorithm to assess the creditworthiness of borrowers. This assessment is based on the borrower’s income, employment history, and credit score. Based on this assessment, the loan app will offer a loan amount and interest rate.

Pros and Cons of Loan Apps

The main advantage of loan apps is that they offer a quick and easy way to access loans. The main disadvantage of loan apps is that they typically have high interest rates.

How to Apply for a Loan from a Loan App

Most loan apps offer an online application process that is quick and easy to use. Borrowers can typically apply for a loan directly from the loan app’s website or mobile app. Once the application is approved, the loan amount will be deposited into the borrower’s bank account.

You can also read our detailed guide on personal loan applications.

FAQ

What are the eligibility requirements for a loan from a loan app?

Loan apps typically have a minimum age requirement of 18 years . Borrowers must also have a regular source of income (e.g. salary) and a valid bank account.

What is the interest rate for loans from loan apps?

The interest rate for loans from loan apps varies depending on the loan amount and repayment period. The minimum interest rate is 2% per month, and the maximum interest rate is 24% per month.

What are the legit online loans in the Philippines?

Some popular lenders include Cashalo, Digido, BillEase, and Home Credit. Each of these companies offers a convenient way to borrow money, whether you need it for an emergency expense or just want to consolidate your debts.

What is the best loan app in the Philippines?

Some popular loan apps include Cashalo, BillEase, and Home Credit. Each of these apps offers a convenient way to borrow money, whether you need it for an emergency expense or just want to consolidate your debts.

How do I choose the right loan?

Make a list of online loans available in the Philippines before applying. This will help you compare different options and find the best deal for your needs. A few famous online loan providers in the Philippines include Cashalo, BillEase, Digido, and Home Credit. Be sure to read the terms and conditions carefully before you apply.

What is the easiest loan to get approved for in the Philippines?

There is no one-size-fits-all answer to this question, as each individual’s financial situation is different. However, some of the easiest loans to get approved in the Philippines include personal salary loans. If you have a good credit score, you may be able to get approved for a loan with a lower interest rate.

Which app is best for giving loans?

It depends on your individual needs and preferences. If you need a loan for a small amount of money, then Cashal may be the best option for you. However, BillEase or Home Credit could be better if you need a larger loan. Whichever app you choose, be sure to compare interest rates and fees before you apply.

Can I borrow money from GCash?

Yes, you can loan money from GCash. However, there are some requirements that you need to meet before you can apply for a loan. For example, you must be at least 18 years old and a resident of the Philippines. You must also have an active GCash account and a valid ID. Once you have met these requirements, you can apply for a loan by going to the GCash app and selecting “Apply for Loan.”

Final Thoughts

Many loan apps are available in the Philippines, each with features and benefits. The best loan app for you will depend on your individual needs and preferences. The loan apps mentioned in this article offer competitive interest rates and flexible repayment terms. So, if you’re looking for a quick and easy way to access a loan, one of these loan apps is likely to be a good option.